Time of extremes

The new coronavirus is spreading rapidly. In Europe, Italy has been the most affected. So much so, that the government felt compelled to restrict the movement of the population across the country. Policymakers around the globe are assessing appropriate measures to support the corona-affected economy. Central banks like the Fed have already responded with interest-rate cuts. More are expected to follow. Additionally, targeted measures are expected from governments to support cash drained small and medium-sized enterprises. Tax reliefs or special depreciation programmes would also quickly relieve the companies' financial burden. Such measures would support not only the economy, but also financial markets. Psychology plays an important role in extreme times like these. The announcement of such measures alone can help calm everybody.

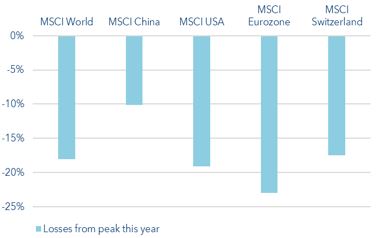

The situation in the markets is exceptional because two external shocks act simultaneously. First, the spread of the coronavirus and its potential economic damage. Secondly, oil prices are falling because oil producers cannot agree on price stabilisation measures. This leads to wild price swings in equities and bonds. Such extreme situations have traditionally been good selling and/or buying opportunities. Against this background, in a first step, we are reducing our USD-bond exposure and are buying US equities.

Significant fall in equity indices

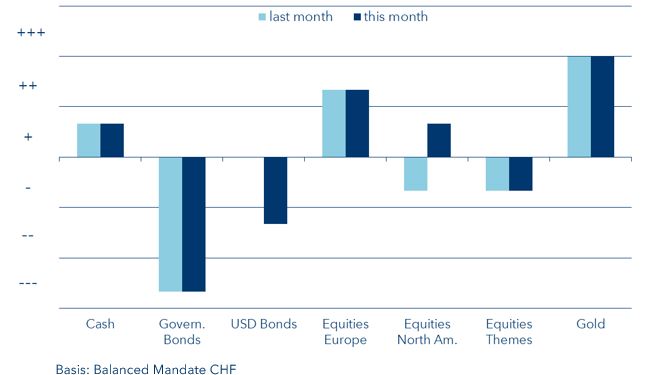

Bonds remain underweighted

In recent days, yields have fallen significantly. In the US, new lows have been recorded. Against this background, we decided to sell some of the USD bonds to realise gains and reduce the interest rate risk in the portfolio.

Equities to overweight

After the sharp correction of the last few days, we increase our US equity position. This puts our overall equity allocation to overweight.

Gold remains overweight

We stick to the gold position. In extreme times, gold plays an important role stabilising the portfolio. The precious metal has played this role convincincly once more time this year.

Tactical deviations

Important legal advice

This documentation was produced by VP Bank AG (hereinafter the bank) and distributed by the companies of the VP Bank Group. This documentation does not constitute an offer or an invitation to purchase or sell financial instruments. The recommendations, estimates and statements contained therein reflect the personal views of the relevant analyst of VP Bank AG at the time of the date stated on the documentation and can be changed at any time without prior notice. The documentation is based on information that is considered reliable. This documentation and the assessments or assessments made therein are prepared with the utmost care, but their accuracy, completeness and accuracy cannot be guaranteed or guaranteed. In particular, the information contained in this documentation may not include all relevant information on the financial instruments covered or their issuers.

For more important information on the risks associated with the financial instruments in this documentation, the proprietary business of the VP Bank Group or the management of conflicts of interest in relation to these financial instruments, and for the distribution of this documentation, see http://www.vpbank.com/rechtliche_Hinweise