Manufacturers face component shortages

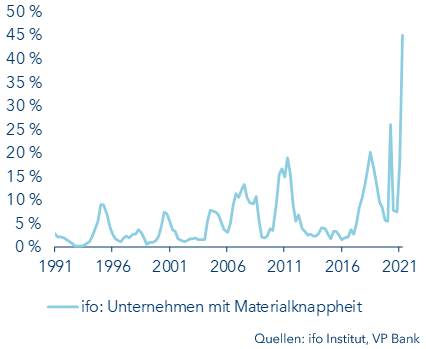

The economic fallout from the Corona crisis is unique in terms of its anatomy. A pandemic of this magnitude is an entirely new and unexpected challenge for today’s globalised manufacturing industry. One major consequence is the acute shortage of basic materials. A glance Germany’s ifo business climate index speaks volumes in this regard: 45% of the companies surveyed complain about the shortage of intermediate goods and raw materials – the highest reading ever recorded (see chart).

Basic materials shortage has become a problem

Reasons for the shortages

The root causes for the current scarcity of materials and components are myriad:

- Container shortage in freight transport

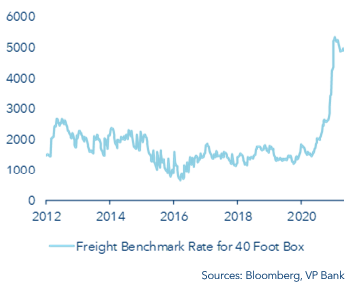

Upon the outbreak of COVID-19 in Asia, local manufacturing went into total lockdown and Asian shipping companies stopped booking empty containers. During the pandemic, however, the demand for Asian electronic equipment surged. The existing containers in Chinese ports were unable to handle the volume. At the same time, lockdowns in the USA and Europe meant that hardly any goods and hence no containers were shipped to Asia. The result: an ongoing container shortage in Asia and a container surplus in the West. In consequence, freight costs for containers, as reflected in the World Container Index compiled by private maritime research institute Drewry, have risen massively (see chart). If statements from various shipping companies are to be believed, this gridlock will only start to dissipate towards the end of the year.

Skyrocketing costs for containers (in USD)

To make things worse, the blockage of the Suez Canal in March caused by the stranded “Ever Green” container ship has exacerbated the shipping problem and thus the materials shortage. Although passage through the canal has been restored, the logistical consequences can still be felt.

- Production stoppages

Especially in Asia, the coronavirus containment measures have been extremely strict, something that has repeatedly led to production halts. What’s more, raw materials producers have opted to use this downtime to service their plants and equipment, given the bleak outlook they were confronted with back in March 2020. Maintenance activities like this are usually planned half a year in advance and frequently take several months to complete. As a result, many raw materials such as industrial metals have also become scarce. There have also been production stoppages due to force majeure (e.g. crippling winter storms in the USA). In Texas, for example, power outages brought semiconductor manufacturers to a standstill. And a disastrous fire in March at a key chip supplier to the automotive industry in Japan made matters worse.

- Changed demand patterns

Even though fewer intermediate products are available at present, demand has increased faster and more intensely than expected – for example, for consumer electronics products and automobiles. First, car sales picked up in China; then, as of last fall, also in Europe and the USA. To meet this demand, electronics suppliers and automakers alike ordered larger quantities of microchips. In the meantime, those suppliers can hardly keep up with production. Moreover, weather phenomena have worsened the problem: the basic material for semiconductors is silicon, and China is the largest producer. Due to droughts, the country’s hydroelectric power plants were temporarily unable to produce sufficient electricity for the production of raw silicon. On top of it all, floods in other regions of China led to production standstills, even as manufacturing activities elsewhere were impaired by the Corona pandemic.

So, will inflation be next?

These logistical difficulties, changing demand patterns and supply shortages are not confined merely to the semiconductor realm. For instance, the construction industry is confronted with a scarcity of plywood and polystyrene. Even things like shrink-wrap and cardboard are in short supply in many places. So logically, this textbook example of a supply/demand imbalance means that prices are on the rise. Producer prices in Germany, as measured by an index that tracks the costs of industrial intermediate goods, are now increasing at the fastest pace in more than a decade – a clear indication of just how hard it is to obtain numerous basic materials at present.

The extent to which this will ultimately flow through and have a lasting effect on consumer prices remains to be seen. The past has occasionally shown that sharp increases in producer prices do not necessarily spur inflation at the consumer level, the most recent example being in 2011 after the financial crisis. And even if there is a flow-through to consumers, this evolves slowly and with a time lag (consumer prices tend to react very sluggishly). So in our opinion, any inflation risks attributable to the current the shortages should be more medium-term in nature. For the time being, we stand by our view that the latest bump in European and US inflation rates is primarily due to base effects and that it will most likely abate in late summer as the prior-year comparables come into play.

Economic momentum is being held back

However, today’s shortage of raw materials and products has direct effects on the economy. The scarcity of semiconductors is taking its toll on the automotive industry in particular. Germany, with its major-league vehicle manufacturers, is especially exposed in this regard and the industrial production recorded an unexpectedly sharp drop in January and February, despite the brimming factory order books.

Germany’s economy therefore suffered much greater damage in the first quarter than it would have without the supply bottlenecks. This stumbling block does not call the economic recovery into question; it just reduces the momentum. In the US, for example, the shortage of various materials could restrain GDP growth by 0.5 to 1 percentage points in the current year.

Equity markets hardly notice

The exceptional circumstances surrounding the pandemic, coupled with the manufacturing sector’s strong demand for specific raw materials and intermediate goods, represent an important theme as the current Q1 reporting season progresses. Company executives are talking about rapidly rising costs of raw materials, energy, logistics and other particularly scarce yet crucial products.

Roughly half of the companies included in the leading US and European share indices (S&P 500 and EuroStoxx 600) have already announced their quarterly results. Thus far, it appears that they have managed to overcompensate for the negative cost factors and production difficulties. The ongoing economic recovery can be expected to provide a tailwind also in the coming quarters, even in the event that more-or-less severe production interruptions were to happen in certain cases.

Automakers are hard hit. The effects are a particularly bitter pill for the industry as most of the companies are now experiencing eager consumer demand after the prolonged slump. US-carmaker Ford, for example, reported a strong first quarter, but warned that the undersupply of semiconductors could force a production cut of up to 50% in the second half of the year. That translates into 1.1 million fewer vehicles coming off the assembly lines. German automakers are not faring any better. BMW is temporarily suspending production of its Minis in Oxford for the same reason.

And Volkswagen has announced that it will have to postpone the production of about 100,000 to 150,000 vehicles (mainly small and midsize) until the coming business year. VW’s e-car models and upmarket SUV segment remain unaffected by this since they typically generate above-average margins. With this measure, Volkswagen and probably other car manufacturers are buying themselves time and minimising the hit to their bottom line.

Given the almost euphoric stock market sentiment at the moment, investors could be quick to show their irritation about further production bottlenecks. That said, even though the economic recovery might be restrained by all of this, it will not be fundamentally called into question; hence, the negative consequences of the shortages should only temporarily weigh on the broader market. Things could look different, however, for the companies suffering the most from supply-chain woes.

Beneficiaries of the bottlenecks

Whilst the construction and automotive industries are more or less bearing the brunt of the primary and intermediate component shortages, other sectors are experiencing a veritable boom. Like the semiconductor industry.

Apart from the world’s big-name microchip manufacturers, there are other players in the industry – take for example Europe’s semiconductor equipment manufacturers ASML, NXP Semiconductors, STMicroelectronics, Infineon or VAT Group – that are also sure to be running at full capacity through the end of the year2021 and are benefitting not just from heightened end-user demand, but also from a certain degree of pricing clout.

On new orders, it should be relatively easy for chipmakers to push through price increases. However, especially vis-à-vis their customers in the automotive industry, the semiconductor companies already have long-term contracts in place. Nevertheless, their position is so strong at present that those customers have no alternative but to wait, since a switch to competitors is essentially not possible due to the lengthy qualification processes involved. As to the other side of the Atlantic Brooks Automation, Lam Research, NVIDIA and Qorvo – are also benefiting from this surge in demand and foresee full capacity utilisation through the end of the year.

But the semiconductor sector is not the only winner in this regard; the packaging industry can also hardly keep up with production. Exports of lumber to China and the USA have reduced the availability of this building material here on the Old Continent – an increasing problem because wooden pallets are crucial for the transport of goods. If the supply shortage in the timber market continues, pallet producers will soon no longer be able to make enough of the things, which in turn will have a negative impact on the overall transport of goods. The Finnish Company, Stora Enso, should also benefit from the strong demand for packaging materials. Moreover, the company is the world’s second largest forestry company in terms of production capacity.

Conclusion

Currently, many industrial companies are facing shortages of commodities or primary products, mainly due to the pandemic. It is not yet clear which producers will be able to pass on the increased prices. It seems certain that companies in the semiconductor sector will benefit. The situation is worse in the automotive sector. Overall, the economic recovery is so strong that it will hardly be thrown off course by the bottlenecks.

Download the file here

Important legal information

This document was produced by VP Bank AG (hereinafter: the Bank) and distributed by the companies of VP Bank Group. This document does not constitute an offer or an invitation to buy or sell financial instruments. The recommendations, assessments and statements it contains represent the personal opinions of the VP Bank AG analyst concerned as at the publication date stated in the document and may be changed at any time without advance notice. This document is based on information derived from sources that are believed to be reliable. Although the utmost care has been taken in producing this document and the assessments it contains, no warranty or guarantee can be given that its contents are entirely accurate and complete. In particular, the information in this document may not include all relevant information regarding the financial instruments referred to herein or their issuers.

Additional important information on the risks associated with the financial instruments described in this document, on the characteristics of VP Bank Group, on the treatment of conflicts of interest in connection with these financial instruments and on the distribution of this document can be found at https://www.vpbank.com/legal_notice_en

Other comments

mir scheint, hier fehlt ein wichtiger Punkt was dei Automobilindustrie angeht: Das rigide Einkaufsverhalten dieser Industrie und der großen Zulieferer. Weshalb sollen Chiphersteller Chips für die Autoindustrie herstellen, wenn es einfacher und lukrativer ist, diese für smart-phones und Co. zu produzieren?