The monetary tightening has begun

How long is a risk a risk and not yet a reality? This question has probably been discussed at length by the governing body of the European Central Bank (ECB). After all, ECB head Christine Lagarde admitted that the latest inflation figures were higher than expected. Talking only about inflation risks was no longer an option. Lagarde therefore emphasised that the ECB would respond to new data. She no longer ruled out a first rate hike this year. First topic on the agenda, however, is the end of securities purchases.

The U.S. Federal Reserve has already gone further in this regard. It will end its bond purchases in March, and a first interest rate hike is also a foregone conclusion, with further hikes likely to follow soon. In addition, the reduction of the balance sheet will probably be tackled soon.

This regime change poses challenges for financial markets. Expectations are being adjusted and high valuations of companies are being questioned. Correspondingly, the start to the year on the stock markets was bumpy, and risk aversion has recently increased.

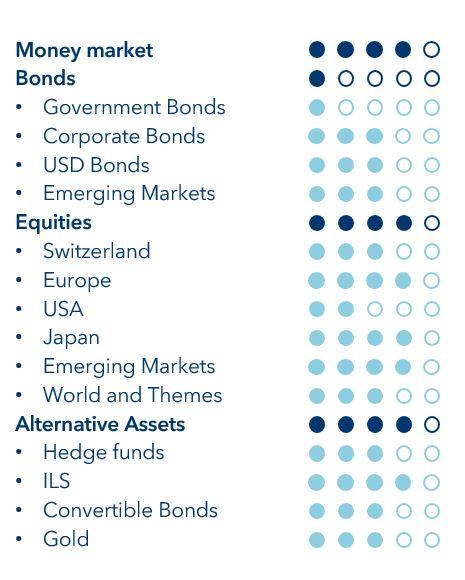

We continue to favour equities and maintain our overweight regardless of these developments. However, we are shifting the regional weightings. We are reducing US equities and increasing emerging markets and Japan in return. These two regions are now in line with Europe.

Monetary policy is acting and its credibility has not been questioned so far. This gives us confidence. According to our new indicator*, there is an improvement in supply chains too. Also, the incoming order situation remains very good.

In bonds and alternative investments, the current allocation remains unchanged for the time being.

* VP Bank Supply Chain Index (link)