QR-bill

—

Today’s payment slips only valid until September 30, 2022

The QR-bill simplifies the issuing and payment of invoices. The new payment slip will include a QR code that contains all the relevant information and offers an array of benefits both for individuals and for businesses. Below you will find a summary of the key facts.

A short guide to the QR-bill

Just like our previously used payment slips, the QR-bill is divided into two parts: a receipt and a payment section. The main difference is the Swiss QR code located in the payment section. It contains all the relevant information needed both to issue an invoice and to make a payment. The information is also clearly written on the bill so that it can still be read and entered manually.

Here we outline the three types of QR-bill:

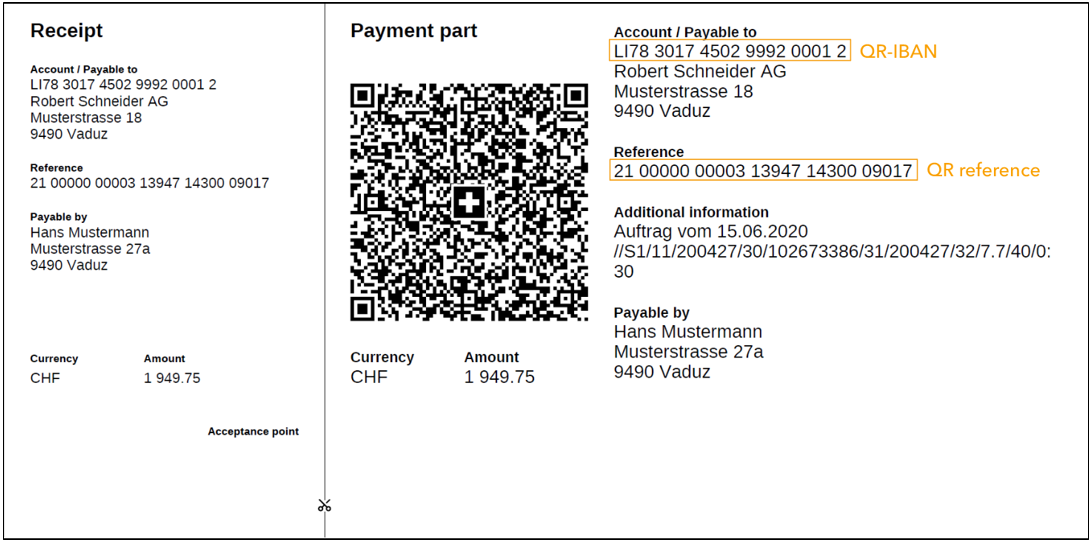

Payment section with a QR reference

This version replaces the orange payment slips and contains a QR-IBAN and a QR reference. The QR reference is equivalent to the ESR reference number and, like its predecessor, allows the bill issuer to check payments against the relevant invoices. Existing ESR reference numbers can still be used as before.

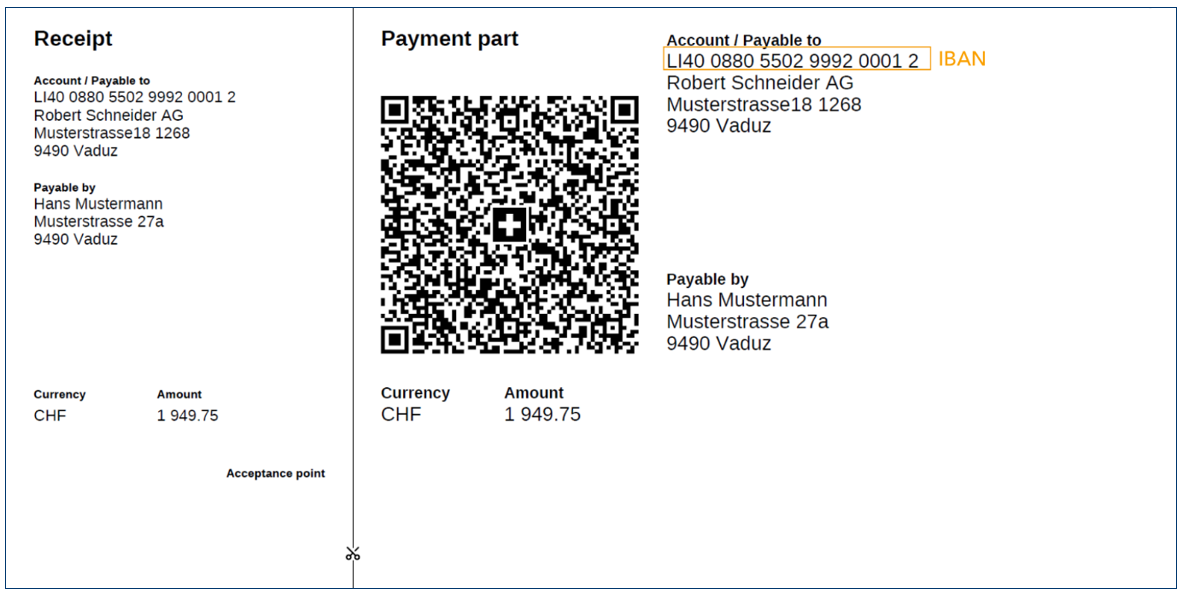

Payment section without a reference

The QR-bill that features an IBAN and no reference replaces the red payment slips. This version enables invoices to be issued simply.

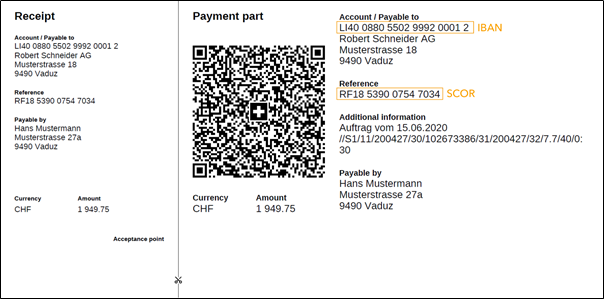

Payment section with a Creditor Reference (SCOR)

The Creditor Reference serves the same function as a QR reference. The difference is that the Creditor Reference can be used in international payment transactions while the above-mentioned payment sections are restricted to the Swiss franc area (Switzerland and Liechtenstein). The IBAN is also used for the account information.

Benefits for bill recipients

- Minimal manual action required as payment information is integrated into the Swiss QR code

- Easy and fast payment via e-banking

- Details automatically entered digitally when code is scanned

- Automated data entry means low error rate

From 30 June 2020, VP Bank will authorise QR-bills as a payment option on the Bank’s e-banking platform. This will allow you to enter and process your invoices with the same ease as before. What is more, VP Bank e-banking offers other exciting features, such as Multiscan and Multipay.

If you work with accounts payable software, you will need to make some technical changes beforehand. Please contact your software partner for guidance. Technical provisions are also required for proprietary developments.

Benefits for bill issuers

- Quick and simple issuing of invoices for businesses

- Improved overview of accounts receivable

- Payments in Swiss francs and euros

- Send QR-bills as PDF files

- Fewer clarifications and corrections in accounts receivable due to high-quality data

Discuss the technical requirements for the issuing of QR-bills with your software partner. The relevant preparations are also required when using proprietary developments.

If in the future you would like to issue QR-bills with a QR reference number, you will require a QR-IBAN assigned by VP Bank. Before you send your first QR-bill, you will also need to switch to camt messaging for the reconciliation of incoming BESR payments. Your client advisor is on hand to offer relevant advice.

Useful tip

The QR-IBAN should not be confused with the IBAN. Both use a different institute identification (IID). The QR-IBAN can be recognised using the IID, which will have a value between 3,000 and 31,999. To make it easier for you to distinguish between the two numbers in future, we have given an example with the relevant section in bold:

IBAN LI40 0880 5501 0008 0001 8

QR-IBAN LI78 3017 4050 2999 2001 2

Frequently asked questions (FAQ)

The QR-bill is a new payment slip that will be used for Swiss payment transactions as from 30 June 2020. It will make it easier to issue and pay bills and replaces today’s red and orange payment slips by October 1, 2022.

Yes, QR-bills can easily be scanned and paid using the app, as well as using VP Bank’s web application.

In order to scan QR-bills, you need to have the VP Bank Connect app installed on your smartphone. You can use the web application to scan one or more QR-bills with your smartphone and complete them in the client portal.

Multipay is not available for payments for which additional details, such as the amount, are required in order to make the payment.

Scanned QR-bills are stored for you in the client portal. The next time you log in, you will be reminded that payments are waiting to be completed.

Go to “Payments” > “Create payment”. Then select “Scan QR-bill”.

If the “Scan QR-bill” option is not visible, this means that you have not yet registered for VP Bank Connect. Order your Connect code here.

You can use our web application to manually record QR-bills in the event that the scanning feature is not activated for QR-bills. Alternatively, you can scan QR-bills using a hand scanner.

Yes, VP Bank offers an automatic payment check for QR-bills with a reference number. Starting 30 June 2020, the QRR transfer service will be automatically available for clients who are already using BESR transfer. If you have not yet used the automatic payment check but are interested in doing so, we will be happy to set up the service for you. Please contact your client advisor to arrange for this.

It is possible to scan QR-bills using a hand scanner. However, this QR code reader must be purchased separately.

The function for recording orange and red payment slips will remain active for as long as this is allowed for Swiss payment transactions, i.e. before cut-off on September 30, 2022.

You can order QR-bills for your bank account at VP Bank. To do so, please contact your client advisor.

Please contact your client advisor for this information.

Pay simply with the QR-bill: www.einfach-zahlen.ch/en/home.html

Frequently asked questions: www.paymentstandards.ch/en/shared/know-how/faq/qr.html