W-shaped recovery on the horizon

Our VP Bank Corona Crisis Barometer has steadily improved in recent weeks and now stands at roughly 80% of its pre-crisis level. The underlying economic recovery was welcomed by the financial markets. Rising stock markets, falling risk premia and decreasing market volatility speak for themselves.

While being delighted with the rapid recovery, there are increasing signs that call for caution. For example, a number of government support measures, such as the suspension of the obligation to file for insolvency in Europe, will expire. It remains to be seen whether the measures will be extended to the same extent. In combination with the renewed regional lockdown measures, this could cause the economic recovery to stall. In terms of its course, this would then be a scenario similar to the letter W.

In addition, the stock market recovery to date has been strongly driven by a small number of companies. US technology stocks in particular have taken off to impressive heights. Underneath the surface, though, the recovery looks less convincing.

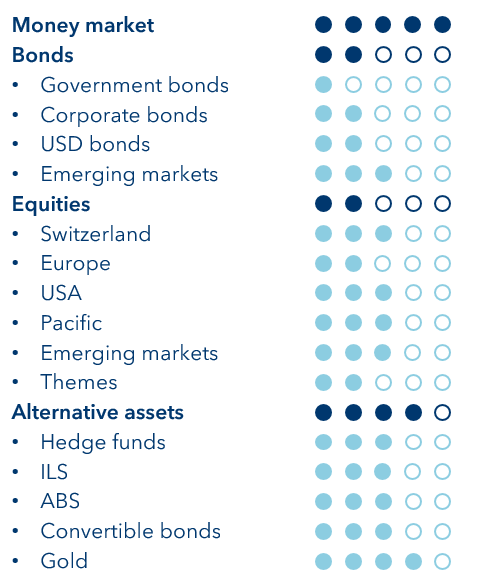

The fact that the price of an ounce of gold has risen above USD 1800 and is thus close to the all-time high of USD 1920 marked in 2011 can also be interpreted as an expression of scepticism. Against this backdrop, we have decided to maintain our cautious approach and leave our tactical positioning unchanged.

Add the first comment