VP Bank Sustainability Score

—

The VP Bank Sustainability Score Methodology

VP Bank incorporates sustainability criteria into the assessment of investments. Our belief is that sustainable investment is beneficial to all investors if put into practice properly. Numerous scientific studies[1] have shown a neutral or positive performance effect.

While there is no uniform definition of sustainability, there is a broad consensus that ESG factors best summarise the criteria. Specialised rating providers determine the extent of an enterprise's impact on the environment (E), how it behaves vis-à-vis different stakeholders (S) and how high the quality of corporate governance (G) is. The VP Bank Sustainability Score (VPSS) is broad based because sustainability for us is more than ESG. More specifically, the score consists of five sub-components:

-

ESG rating

-

ESG momentum

-

Business practices

-

Business activity

-

Sustainable Development Goals and impact

Each of these sub-categories is assessed according to a specially developed methodology. The VP Bank Sustainability Score was designed in such a way that, in addition to its obvious positive impact on sustainable economic activity, investments with a high value also have a better long-term risk-opportunity-ratio.

1. ESG rating

1. ESG rating

The starting point of the VP Bank Sustainability Score is the ESG rating by MSCI, a data provider. It is based on the basic components environment (E), social affairs (S) and governance (G). This classification results in a sustainability profile of an enterprise, a state or state agency or a fund. ESG factors show how, for example, a company is prepared to deal with future risks such as climate change or changes in society like shifting consumer habits. Factors are varying depending on the sector and the asset class.

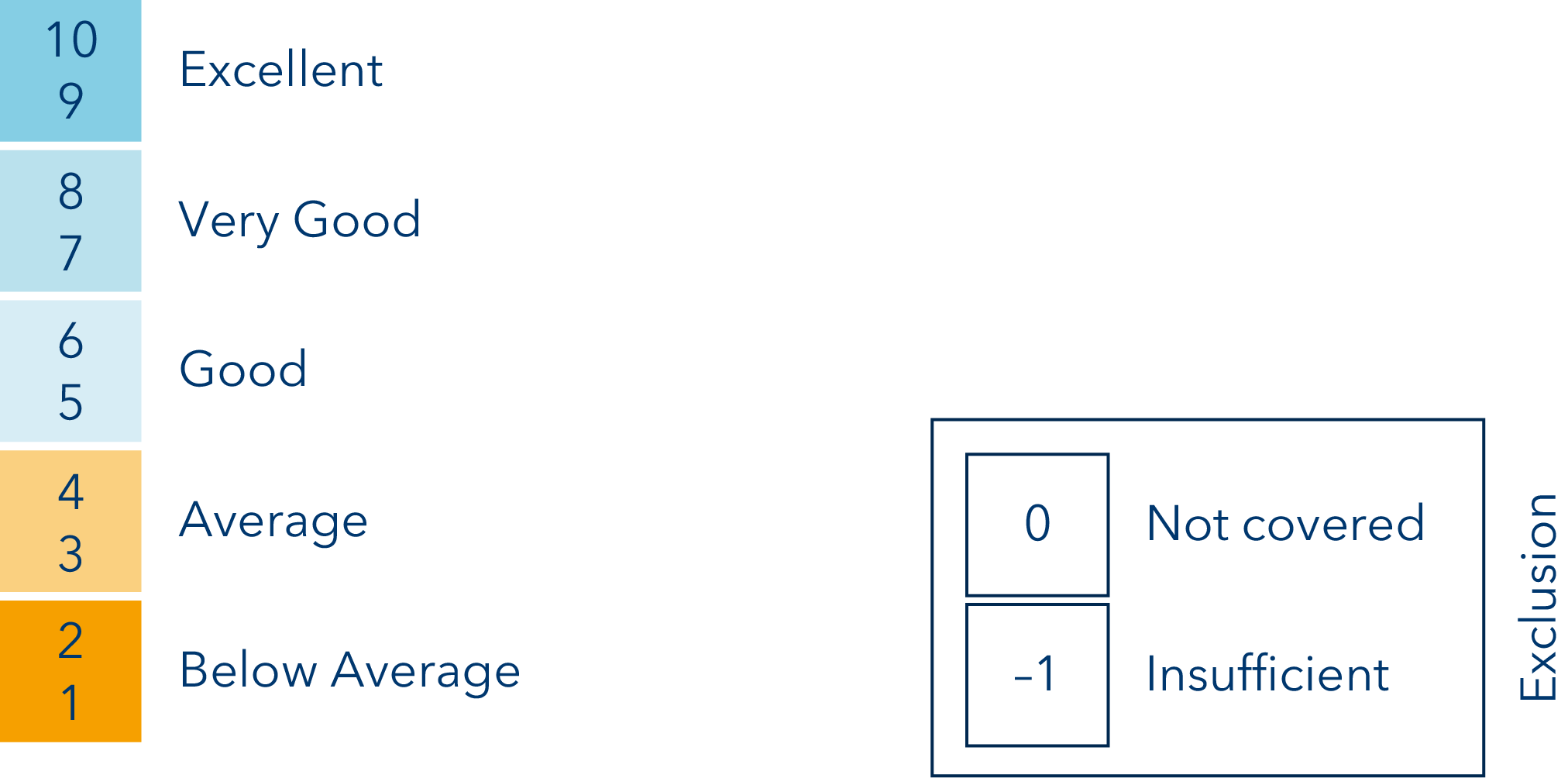

Results: Our rating scale ranges from "insufficient" to "excellent".

Minimum requirement: All individual stocks or bonds must have at least a BB rating in order to qualify for our recommendation lists. We exclude the lowest two rating grades according to the MSCI rating, B and CCC. In addition to this minimum requirement for individual securities, we also set a high standard for the portfolios of the VP Bank Risk Optimised ESG funds.

In the case of third-party funds and ETFs, a certain minimum proportion of the portfolio has to be covered by MSCI. The proportion of securities with a B and CCC rating should be lower, but at most the same as that of the regional reference index. Breaching of certain levels will lead to a reduction of the score.

2. ESG Momentum

2. ESG Momentum

The momentum indicator measures to what extent and in what direction the ESG rating has changed. We reward companies or governments or sovereign debtors that improve their sustainability rating. Those who pay little or no attention to the ESG aspects resulting in a downgrade, will be penalised. Scientific studies[2] have shown that investments with a positive ESG momentum tend to develop better than the overall market. Taking the rating momentum into account, preference will be given to those who could set up an ESG rating premium in the future. This leads to a better timing since many professional investors are only paying attention to ESG ratings and are not allowed to buy shares or corporate bonds under their statutes until the rating has been issued.

Results: Improvement or worsening of score.

Minimum requirement: None. The momentum indicator affects the overall score positively or negatively, but does not result in exclusion from a recommendation.

In the case of third-party funds and ETFs, we pay attention to the net result of the securities held with a rating improvement less those with a deterioration.

3. Business practices

3. Business practices

Bribery, exploitation and child labour are examples of businesses practices that are illegal or in breach of international standards. This sub-component assesses the behavior and commercial policy of an enterprise. VP Bank is guided by the three internationally recognised standards "UN Global Compact", "United Nations Guiding Principles for Business and Human Rights" and "International Labour Organization (ILO) Labour Standards", as well as the controversies identified by MSCI. The latter are assessed separately, as certain aspects are not included in the ESG rating at all or to a low degree. For example, in our methodology, the violation of competition law investigated by the authorities may lead to an exclusion of a security if the violation is classified as "very severe". In other cases, bonus points are awarded for good business conduct and deductions are made for "severe" controversies.

Results: Exclusion or improvement or worsening of score.

Minimum requirement: A breach of the above international standards or a "very severe" controversy leads to an exclusion from our stock and bond recommendations. VP Bank ESG funds also exclude direct investment in such companies.[3]

In the case of third-party funds and ETF recommendations, the accepted share of investments held by the fund with breaches of international standards and "very severe" controversies is very low.

4. Business activity

4. Business activity

For this sub-category, the business lines of a corporation are analysed. The main focus is on ethical criteria that are matched against the turnover or the practices of a company. There is a gradual approach in the VP Bank methodology. "Critical" business areas are defined as tobacco, gambling, thermal coal, nuclear and controversial weapons. Above a 5% threshold these activities lead to exclusion, yet any links to controversial weapons are equal to exclusion. This means that a company is not recommended to buy because of its business activities. "Borderline" businesses include pornography, small arms, nuclear energy, genetically modified organisms (GMOs), oil sands[4], for-profit prisons[4] and fur[4]. They shall result in a deduction depending on the extent of the deduction. Again, a threshold of 5% of the portfolio or turnover applies, if not measurable, the mere link to any of these issues will reduce the score. Conventional weapons, fossil fuels[4] and animal welfare are classified as "questionable" and may have a negative impact on the score if the proportion exceeds 5% or if there is a link. All of these areas of business are being questioned if there is a greater focus on sustainability. Accordingly, there is a risk that investors will exit such assets on a large scale, which may lead to higher capital costs and lower performance. Companies that do not operate in any of the above mentioned areas will receive a bonus.

Results: Exclusion or improvement or worsening of score.

Minimum requirement: Companies that breach thresholds in business areas we classify as "critical" won‘t be recommended. VP Bank ESG funds are not allowed to invest in such assets.[3]

The portfolio of third-party funds and ETFs may only contain a very small proportion of companies operating in areas considered "critical".

5. SDG and Impact Score

5. SDG and Impact Score

Truly sustainable companies not only operate sustainably, but their activities also contribute to the achievement of the UN's Sustainable Development Goals (SDGs). The SDGs are the core of the 2030 Agenda and take into account the economic, social and environmental dimensions of sustainable development. The SDG and Impact Score therefore compares a company's products and activities or dedicated impact solutions with the 17 UN development goals and measures the extent to which they contribute to or contradict the achievement of the goals. The measurement is done separately for each of the 17 goals. These are then combined to form the SDG and impact score. Critical activities are defined for each goal. For the activities, the negative impact tends to be measured on the operational side, for example on the basis of controversies that can be assigned to an SDG. For the activities, on the other hand, both negative and positive aspects of revenue generation are measured.

Results: Depending on the score, there is an improvement or a worsening of the overall result.

Minimum requirements: None. The SDG and impact score affects the overall score positively or negatively, but does not lead to exclusion.

On a fund level, there exists an aggregated version of each SDG and impact score.

[1] Friede, Busch and Bassen (2015): ESG and financial performance; aggregated evidence from more than 2000 empirical studies; Journal of Sustainable Finance & Investment, Volume 5, Issue 4, p. 210-233, sowie Clark, Feiner and Viehs (2015): From the stockholder to the stakeholder; How sustainability can drive financial performance

[2] Giese et al, Foundations of ESG Investing (2019): How ESG Affects Equity Valuation, Risk, and Performance; The Journal of Portfolio Management; Volume 45

[3] A rating change will be incorporated at the next rebalancing.

[4] Only available on a single stock level.